CRS Common Reporting Standard. Common Reporting Standard CRS for the Automatic Exchange of Financial Account Information.

Common Reporting Standard Crs Organisation For Economic Co Operation And Development

The CRS was developed by the Organisation for Economic Development and Cooperation OECD to put a global model of automatic exchange of information into practice.

. On 23 December 2016 Malaysia introduced several new legislations as part of its commitment to support and implement the CRS. Common Reporting Standard CRS CRS Submission. The CRS was developed by the Organisation for Economic Development and Cooperation OECD to put a global model of automatic exchange of information into practice.

Under the CRS we are required to determine where you are tax resident this will usually be where you are liable to pay income or corporate taxes. Scanning the completed and signed copy to revert via email to. CRS is an internationally-agreed standard of information-gathering and reporting requirements for financial institutions introduced by the Organisation for Economic Co-operation and Development OECD.

B Clarify the options which Malaysia has adopted in respect to the CRS implementation. The Common Reporting Standards CRS aims to enable tax authorities to tackle offshore tax evasion by providing a greater level of information on their residents wealth held abroad. Reporting obligations under the Common Reporting Standard CRS.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. B Clarify the options which Malaysia has adopted in respect to the CRS implementation. Common Reporting Standard CRS is a global standard for automatic exchange of information AEOI on financial account information between the governments in order to combat offshore tax evasion and protect the integrity of taxation systems.

This is known as the Common Reporting Standard the CRS and wed like to help you understand what it means for you. Commercial Banking Malaysia. To help fight against tax evasion and protect the integrity of tax systems governments around the world are introducing a new information-gathering and reporting requirement for financial institutions.

Reporting obligations under the Common Reporting Standard CRS. This is known as the Common Reporting Standard the CRS and wed like to help you understand what it. Please ensure that your email address is.

Under the CRS we are required to determine where you are tax resident this will usually be where you are liable to pay income or corporate taxes. A The Income Tax Multilateral Competent Authority. Common Reporting Standard Guidance Notes Guidance Notes issued by the Malaysian Inland Revenue Board Malaysian IRB on 5 February The CRS reporting obligations being now law in Malaysia is further explained and implemented through the Guidance Notes and the Malaysian IRB website which provides the following key.

What is the Common Reporting Standard CRS. Malaysia has committed to exchange the CRS information from 2018 and would also be receiving financial account information on Malaysian residents from other countries tax authorities. Under the Common Reporting Standard CRS for the Automatic Exchange of Financial Account Information Malaysian Financial Institutions are required to collect and report to Inland Revenue Board of Malaysia IRBM financial account information on non-residents.

Common Reporting Standards Impact in Malaysia and ASEAN The Common Reporting Standards CRS aims to enable tax authorities to tackle offshore tax evasion by providing a greater level of information on their residents wealth held abroad. Effective from 1st July 2017. The CRS was developed by the Organisation for Economic Development and Cooperation OECD to put a global model of automatic exchange of information into practice.

The CRS was developed by the Organisation for Economic Development and Cooperation OECD to put a global model of automatic exchange of information into practice. This is known as the Common Reporting Standard the CRS and we would like to help you understand what it means for you. And reporting obligations under the Common Reporting Standard CRS.

And reporting obligations under the Common Reporting Standard CRS. This is known as the Common Reporting Standard the CRS and wed like to help you understand what it means for you. Over 100 countries jurisdictions including Malaysia have committed to CRS.

This will help ensure that residents with financial accounts in. This is known as the Common Reporting Standard the CRS and wed like to help you understand what it. The main objective is to help tax authorities around the world identify taxpayers who.

Submit Common Reporting Standard CRS declaration via HSBC Malaysia Online Banking. The Common Reporting Standard CRS is an information standard for the Automatic Exchange Of Information AEOI regarding financial accounts on a global level between tax authorities which the Organisation for Economic Co-operation and Development OECD developed in 2014. B Clarify the options which Malaysia has adopted in respect to the CRS implementation.

Headquarters of Inland Revenue Board Of Malaysia. To help fight against tax evasion and protect the integrity of tax systems governments around the world are introducing a new information-gathering and reporting requirement for financial institutions. B Clarify the options which Malaysia has adopted in respect to the CRS implementation.

XBRL is a well-accepted international data exchange standard that promotes efficient data capture dissemination and market transparency. Common Reporting Platform XBRL Beginning May 2015 Securities Commission Malaysia SC is using the eXtensible Business Reporting Language for statistics financial and regulatory reporting. Its purpose is to combat tax evasionThe idea was based on the US.

Once you have login go to Services at the top menu under Tools Services select Update CRS status. The data collected may be transmitted by IRBM for.

10 Non Crs Countries For Banking Privacy In 2022

Common Reporting Standard Crs Organisation For Economic Co Operation And Development

Common Reporting Standard Crs Readiness Deloitte Us

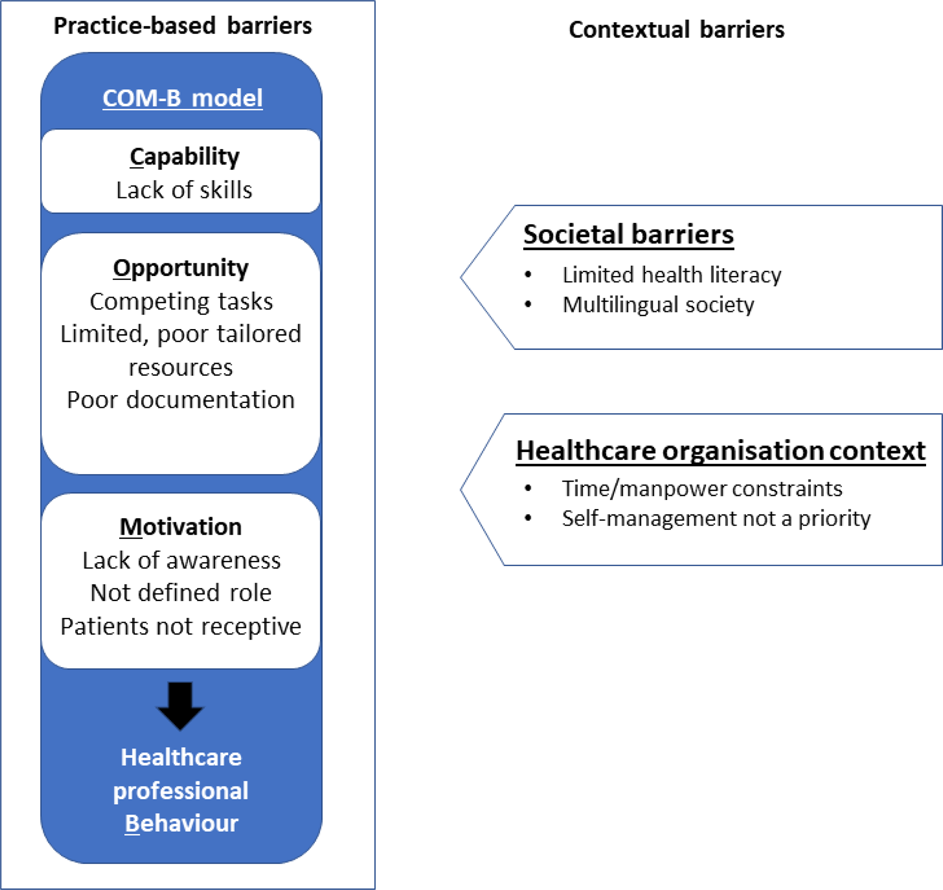

Barriers To Implementing Asthma Self Management In Malaysian Primary Care Qualitative Study Exploring The Perspectives Of Healthcare Professionals Npj Primary Care Respiratory Medicine

Common Reporting Standard Crs Services Tmf Group

Common Reporting Standard Crs Organisation For Economic Co Operation And Development

Common Reporting Standard Crs Organisation For Economic Co Operation And Development

Common Reporting Standard Crs Organisation For Economic Co Operation And Development

Common Reporting Standard Crs Rhb Malaysia

Common Reporting Standard Status Message Xml Schema User Guide For Tax Administrations Oecd

Fatca And Crs In The Middle East Deloitte Middle East Tax Services

6 Differences Between Sole Proprietorship And Sdn Bhd In Malaysia Tetra Consultants

Common Reporting Standard Crs Organisation For Economic Co Operation And Development

U S Non Participation In The Common Reporting Standard Crs